State Permits / State Authority

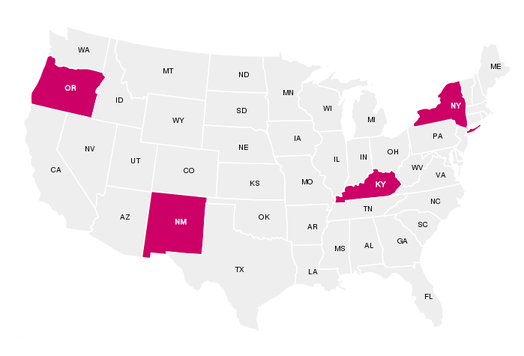

There are four states requiring an additional permit to haul loads for-hire through their state. These permits are in addition to the MC Authority.

- KYU#

-

Kentucky requires trucks and tractors with trailers plated at 60,000-lbs or heavier to register for a Kentucky KYU number if these vehicles are going into Kentucky.

Carriers with FMCSA Authority, Exempt Carriers For Hire, Private Carriers, and farm-plated trucks, at 60,000-lbs or heavier are required to register for a KYU number. The Kentucky KYU is a weight-distance tax which amounts to 2.85 cents per mile of travel in Kentucky. Quarterly weight-distance tax filings must be done in the month following each Quarter.

Registration must be done before entering the state.

We will file your KYU application for a fee $50 for one vehicle.

Contact PDL for more information.

- NY HUT

-

The NYHUT permit or New York Highway Use Tax number is one of these additional permits. If you travel through the state of New York, and are commercially plated for more than 18,000lbs., you will need to register with the NY department of Taxation and Finance.

Anytime you add additional trucks or trade trucks you must obtain a new permit before entering New York. The New York Highway Use Tax does require you to do quarterly filings to maintain the permit.

We will file your NYHUT application for a fee $65 for one vehicle.

Contact PDL for more information.

- NM MTD#

-

The NM MTD# or New Mexico Weight Distance permit is also one of the additional permits. If you travel through the state of New Mexico, and are commercially plated for more than 26,000 lbs., you will need to register with the New Mexico Taxation and Revenue Department for a Weight Distance Tax Identification Permit.

This permit will make it easier to pass through scales when entering and exiting the state of New Mexico. This permit does require quarterly filings to maintain the permit. This permit does require a yearly renewal.

We will file your NM application for a fee $47 for one vehicle.

Contact PDL for more information.

- OR

-

Oregon's Highway-Use Tax is a weight-distance tax based on the number of miles traveled in Oregon and the weight of the vehicle. You need an Oregon Weight Receipt and Tax Identifier if your vehicle travels through Oregon and has a gross weight of more than 26,000 pounds.

Once an Oregon permit has been issued, monthly reports must be filed. After one year, if your account is in good standing, you may apply to report on a quarterly basis. In addition to an ODOT Weight Receipt and Tax Identifier, Oregon requires a bond of all new carriers. The amount of this bond varies.

Contact PDL for more information.